What is the HS Code for Türkiye?

What is the HS Code for Turkey?

What is the HS Code for Turkey?

In international trade, every product is assigned a unique classification number known as the HS code (Harmonized System Code). This system is used worldwide to standardize product identification for customs, tariffs, and trade regulations. In Turkey, the equivalent of the HS code is known as the GTIP (Gümrük Tarife İstatistik Pozisyonu) Code.

If you are an importer or exporter, knowing the GTIP code Turkey is essential for ensuring smooth trade transactions, avoiding customs issues, and determining the correct tax rates. In this article, we will explore what the GTIP code is, how to conduct a GTIP code search, the importance of HS code search, and how platforms like List of Company can help businesses find the correct classification.

What is the GTIP Code?

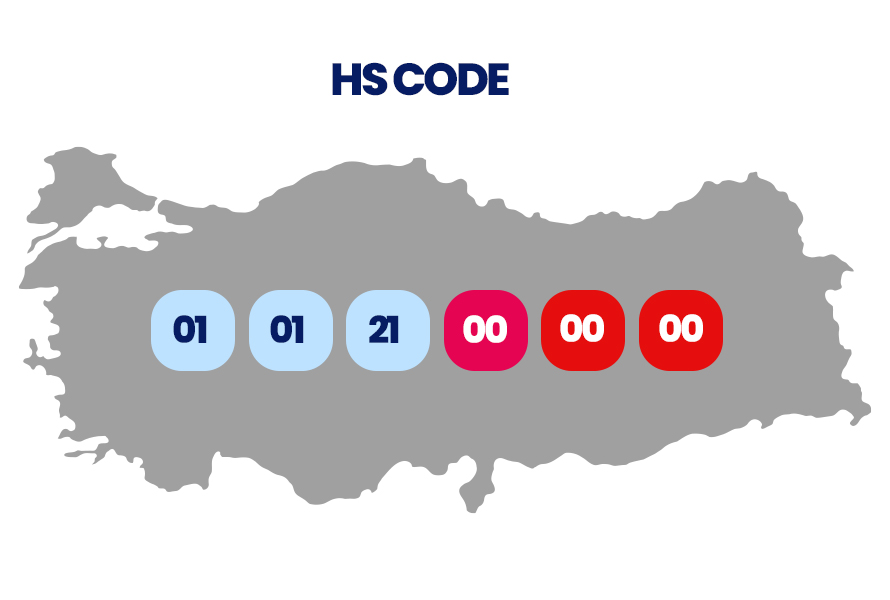

The GTIP code is Turkey’s version of the HS code, developed to provide a more detailed classification of goods. While the HS code is a globally recognized 6-digit number, Turkey extends this system to 12 digits to specify product categories further.

Each GTIP code consists of the following parts:

- First 6 digits: These represent the global HS code system, which is used in almost every country for product classification.

- Next 2 digits: These digits further categorize the product according to Turkey's specific trade regulations.

- Last 4 digits: These are unique to Turkey and provide additional details about taxation, trade policies, and special regulations.

How to Conduct a GTIP Code Search?

Finding the correct GTIP code is crucial for importers and exporters to ensure that they are paying the correct duties and complying with Turkish customs regulations. Here are some of the best ways to conduct a GTIP code search:

- Official Turkish Customs Database: The Gümrük ve Ticaret Bakanlığı (Ministry of Customs and Trade) provides an online system where businesses can search for GTIP codes and their corresponding tax rates.

- List of Company: Platforms like List of Company simplify the process of finding the most accurate and up-to-date GTIP code Turkey classifications, helping businesses streamline their trade operations.

- World Customs Organization (WCO): The WCO database provides a reliable source for conducting an HS code search and understanding international trade classifications.

- Trade Consultants and Customs Brokers: Businesses that deal with a variety of products often rely on customs experts to ensure accurate classification and prevent misfiling.

- Online HS Code Search Tools: Various international trade websites provide HS code search tools that can help businesses find the right GTIP code based on product descriptions.

By using these resources, companies can avoid potential delays, fines, and misclassifications when dealing with customs procedures.

Why Is the GTIP Code Turkey Important?

Using the correct GTIP code is essential for businesses involved in international trade. Here’s why:

- Accurate Tax Calculation: Import and export duties, VAT, and additional charges are determined based on the assigned GTIP code. Incorrect classification can result in overpaying or underpaying taxes, leading to penalties.

- Customs Clearance: When shipping goods internationally, customs authorities use the GTIP code to verify the product’s classification. Errors in coding can cause delays, fines, or rejection of shipments.

- Compliance with Trade Regulations: The GTIP code Turkey ensures that businesses comply with Turkish and international trade laws. Some products may require special licenses or documentation based on their classification.

- Taking Advantage of Trade Agreements: Certain HS codes qualify for reduced tariffs under Turkey’s free trade agreements (FTAs). Businesses can save significant costs if they use the correct GTIP code that aligns with these agreements.

- Avoiding Penalties and Legal Issues: Misclassification of products can lead to severe penalties, product confiscation, or legal disputes. Using a reliable HS code search system prevents such risks.

For example, if you are exporting textiles, using the wrong GTIP code could result in higher import duties or even customs rejection. That’s why businesses must take HS code search seriously and ensure they classify their products correctly.